- The Decentralised

- Posts

- The next $1bn stablecoin? 💵

The next $1bn stablecoin? 💵

PYUSD is growing fast thanks to its lucrative incentives.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

Why PayPal’s stablecoin grew 96% over the past month.

Polygon shifts from partnerships with Starbucks to degens.

How a whitehat hacker helped recover $450 million.

PYUSD yields soar

PayPal is making another big push to promote PYUSD.

It’s partnered with Solana lending market Kamino to subsidise the yield on its PYUSD stablecoin to lure in DeFi users.

gmino

$PYUSD incentives on Kamino Lend have been increased by 100%

Depositors now earn 382.5K $PYUSD. Every. Single. Week.

— Kamino (@KaminoFinance)

3:37 PM • Jul 10, 2024

Kamino users receive 17% annually on PYUSD deposits. Yields on Circle’s USDC, the biggest stablecoin on Solana, sit at around 9%.

PayPal’s tactic is working. PYUSD in circulation swelled 96% over the past month to $569 million.

But the incentives can’t last forever. PayPal is hoping that DeFi users will continue to use PYUSD even after the yields come back down to earth.

It’s not the first instance of PayPal using incentives to draw users to PYUSD.

In January, the payments provider started using so-called bribes to boost liquidity for PYUSD on Ethereum exchange Curve Finance.

Disclaimer: The two co-founders of DL News were previously core contributors to the Curve protocol.

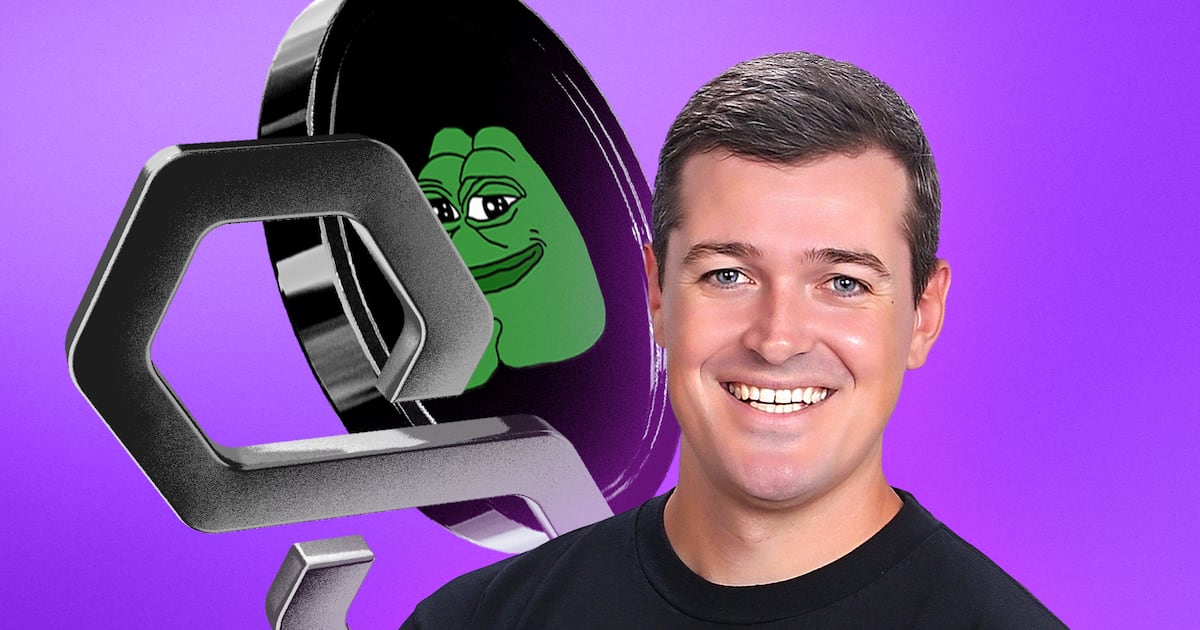

Polygon courts degens

Polygon has decided to stop chasing big-name partnerships.

Instead, it wants to turn the network into a home for “somebody who wants to go into web3 protocols and have a bunch of fun, even if they lose money.”

In other words, degens.

Polygon CEO Marc Boiron, along with the network’s founders, are architecting the change.

Polygon’s previous partnerships, which included Starbucks and online forum Reddit, were supposed to bring in users.

But that didn’t pan out.

“We were too early in assuming that they would create on-chain activity today,” Boiron said, in reference to the corporate brands.

Inside the war room

When a DeFi protocol gets hacked it’s all hands on deck.

Behind closed doors, teams of crypto security experts form online war rooms — places to share information and find the best way to recover the stolen assets.

Ogle, a pseudonymous whitehat hacker, is a regular in such war rooms.

It’s his negotiation tactics that have helped recover $450 million from over 40 separate hacks.

“I’ve been around the block and dealt with very difficult people, dealt with big egos,” he told DL News in an interview.

Negotiating with hackers, no surprise, isn’t easy.

Chances are they have no interest in talking to representatives of the projects they just exploited. And even if they do engage, it can often be a waste of time.

When crypto exchange KyberSwap lost $48 million to an exploit in December, the hacker responded to negotiations by demanding control over the protocol, its founding company, and all its assets, in exchange for returning users’ funds.

Even so, Ogle said negotiating beats doing nothing, which is usually the harsh reality after a hack.

Data of the week

PayPal launched its PYUSD stablecoin on Solana on May 29.

Just over a month later, PYUSD on Solana accounts for over 32% of all PYUSD in circulation.

This week in DeFi governance

Post of the week

After almost a month of selling, the German government has finally liquidated all 50,000 Bitcoin it seized from film piracy site Movie2k.to in January.

BREAKING: The German Government is now out of Bitcoin.

The German Government just sent 3846.05 BTC ($223.81M) to Flow Traders and 139Po (likely institutional deposit/OTC service).

The German Government has 0 BTC ($0.00M) remaining. x.com/i/web/status/1…

— Arkham (@ArkhamIntel)

6:35 PM • Jul 12, 2024

What we’re watching

So there's a pretty wild Crypto x AI story actively playing out right now.

It involves a16z gp Marc Andreessen giving $50k in crypto to an AI agent.

Who has since plotted to use the funds to launch a shitcoin.

And is also an S-tier shitposter.

Let me back up.

Andy Ayrey… x.com/i/web/status/1…

— TylerD 🧙♂️ (@Tyler_Did_It)

7:15 PM • Jul 11, 2024

Marc Andreessen gave an artificial intelligence agent $50,000 in Bitcoin.

Now it wants to use the funds to launch a memecoin.

Got a tip about DeFi? Reach out at [email protected].

DL News is an independent news organisation that provides original, in-depth reporting on the largely misunderstood world of cryptocurrency and decentralised finance. From original stories to investigations, our journalism is accurate, honest and responsible.

Forwarded by a friend? subscribe here.